The Future of Cryptocurrency Exchanges and Trading Platforms

- The Rise of Decentralized Exchanges

- Innovations in Cryptocurrency Trading Technology

- Regulatory Challenges and Compliance Issues

- The Impact of Institutional Investors on Crypto Exchanges

- The Role of Artificial Intelligence in Trading Platforms

- Security Concerns and Solutions for Cryptocurrency Exchanges

The Rise of Decentralized Exchanges

In recent years, there has been a noticeable shift towards decentralized exchanges in the cryptocurrency trading landscape. These platforms operate without a central authority, allowing users to trade directly with one another. This rise of decentralized exchanges is driven by a desire for increased security, privacy, and control over one’s assets.

Decentralized exchanges offer several advantages over their centralized counterparts. One of the key benefits is the elimination of a single point of failure, reducing the risk of hacking or other security breaches. Additionally, decentralized exchanges do not require users to trust a third party with their funds, as trades are executed through smart contracts on the blockchain.

Another advantage of decentralized exchanges is the ability to maintain privacy and anonymity while trading. Since users do not need to create accounts or provide personal information, their identities are protected. This is particularly appealing to those who value their privacy and want to avoid potential surveillance or data breaches.

Furthermore, decentralized exchanges give users more control over their assets. By using non-custodial wallets, traders retain ownership of their funds throughout the trading process. This eliminates the risk of losing funds due to exchange insolvency or mismanagement.

Overall, the rise of decentralized exchanges represents a significant shift in the cryptocurrency trading landscape. As more users seek increased security, privacy, and control over their assets, decentralized exchanges are likely to continue gaining popularity in the future.

Innovations in Cryptocurrency Trading Technology

Cryptocurrency trading technology has seen significant advancements in recent years, revolutionizing the way traders buy and sell digital assets. These innovations have led to increased efficiency, security, and user experience on cryptocurrency exchanges and trading platforms. One of the key developments in this space is the implementation of **automated trading** algorithms, which allow users to execute trades based on predefined criteria without the need for manual intervention. This has helped traders capitalize on market opportunities in real-time and minimize the risk of human error.

Another notable innovation in cryptocurrency trading technology is the integration of **artificial intelligence** (AI) and machine learning algorithms. These technologies analyze vast amounts of data to identify patterns and trends, helping traders make informed decisions and optimize their trading strategies. AI-powered tools can also provide personalized insights and recommendations based on individual trading behavior, enhancing the overall trading experience for users.

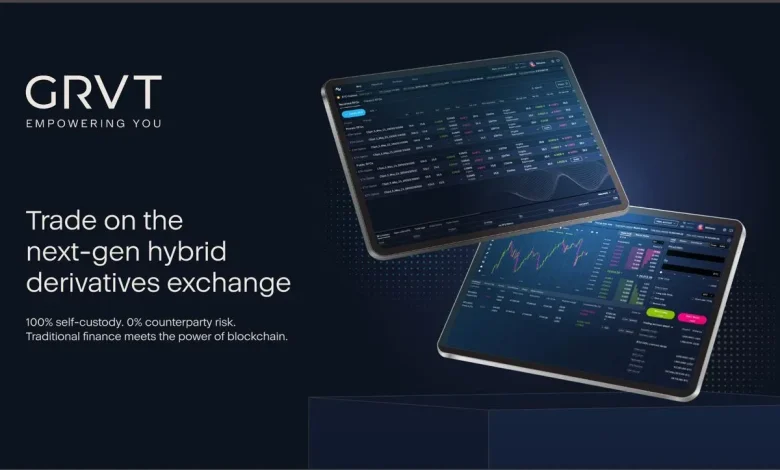

Furthermore, the rise of **decentralized exchanges** (DEXs) has introduced a new paradigm in cryptocurrency trading technology. Unlike traditional centralized exchanges, DEXs operate on blockchain networks, allowing users to trade directly with one another without the need for intermediaries. This not only enhances security and privacy but also promotes **financial sovereignty** by giving users full control over their funds.

Overall, these innovations in cryptocurrency trading technology are shaping the future of exchanges and trading platforms, making them more efficient, secure, and user-friendly. As the industry continues to evolve, we can expect to see even more advancements that will further enhance the trading experience for cryptocurrency enthusiasts around the world.

Regulatory Challenges and Compliance Issues

One of the major challenges facing cryptocurrency exchanges and trading platforms is navigating the complex regulatory landscape. As the popularity of cryptocurrencies continues to grow, governments around the world are implementing regulations to monitor and control the use of digital assets. This has led to a number of compliance issues for exchanges, as they must ensure they are following all relevant laws and regulations.

One of the key regulatory challenges for cryptocurrency exchanges is the issue of anti-money laundering (AML) and know your customer (KYC) regulations. These regulations require exchanges to verify the identity of their users and monitor transactions for suspicious activity. Failure to comply with these regulations can result in hefty fines and even the shutdown of the exchange.

Another regulatory challenge facing cryptocurrency exchanges is the lack of clarity around tax laws. Many governments have not yet established clear guidelines for how cryptocurrencies should be taxed, leading to uncertainty for exchanges and traders alike. This can make it difficult for exchanges to accurately report their earnings and for traders to understand their tax obligations.

Overall, navigating the regulatory challenges and compliance issues facing cryptocurrency exchanges and trading platforms requires a deep understanding of the legal landscape and a commitment to staying up to date on any changes. By proactively addressing these challenges, exchanges can ensure they are operating within the bounds of the law and building trust with their users.

The Impact of Institutional Investors on Crypto Exchanges

Institutional investors play a significant role in the cryptocurrency market, impacting exchanges in various ways. These investors, such as hedge funds, pension funds, and asset management firms, bring large amounts of capital into the market, increasing liquidity and stability. Their involvement can also lead to increased credibility and mainstream acceptance of cryptocurrencies.

One of the key impacts of institutional investors on crypto exchanges is the potential for increased trading volumes. With their substantial financial resources, these investors have the ability to execute large trades, which can significantly impact the price of cryptocurrencies. This increased trading activity can create more opportunities for retail traders and investors to participate in the market.

Furthermore, institutional investors often conduct thorough due diligence before entering the cryptocurrency market, which can help improve transparency and reduce the risk of fraud and manipulation. Their presence can also lead to the development of more sophisticated trading tools and strategies, benefiting all participants in the market.

However, it is essential to note that the entry of institutional investors into the cryptocurrency market can also bring challenges. For example, their large trades can lead to price volatility, which may impact smaller traders and investors. Additionally, the influence of institutional investors on exchanges can potentially centralize control in the hands of a few large players, which goes against the decentralized nature of cryptocurrencies.

Overall, the impact of institutional investors on crypto exchanges is a complex and multifaceted issue. While their involvement can bring benefits such as increased liquidity and credibility, it also poses challenges that need to be carefully considered and addressed to ensure a fair and efficient market for all participants.

The Role of Artificial Intelligence in Trading Platforms

Artificial intelligence (AI) plays a crucial role in modern trading platforms, including cryptocurrency exchanges. AI algorithms analyze vast amounts of data in real-time to identify patterns and trends, helping traders make informed decisions. These AI-powered tools can execute trades at high speeds and with precision, minimizing human error and maximizing profits.

AI in trading platforms can also provide valuable insights and predictions based on historical data and market conditions. By leveraging machine learning algorithms, AI can adapt to changing market dynamics and optimize trading strategies accordingly. This technology has revolutionized the way traders operate, allowing for more efficient and effective trading strategies.

Furthermore, AI can help detect fraudulent activities and prevent security breaches on trading platforms. By continuously monitoring transactions and user behavior, AI algorithms can flag suspicious activities and protect users’ assets. This enhanced security feature is essential in the cryptocurrency market, where the risk of cyber attacks is high.

In conclusion, the integration of artificial intelligence in trading platforms has significantly improved the trading experience for users. From advanced data analysis to enhanced security measures, AI technology continues to drive innovation in the cryptocurrency exchange industry. As AI algorithms become more sophisticated, traders can expect even greater efficiency and profitability in their trading activities.

Security Concerns and Solutions for Cryptocurrency Exchanges

Security is a major concern for cryptocurrency exchanges due to the high value of digital assets being traded. There have been several instances of exchanges being hacked, resulting in significant financial losses for users. To address these security concerns, exchanges have implemented various solutions to protect user funds and data.

- One common security measure is the use of two-factor authentication (2FA) to verify user identities and prevent unauthorized access to accounts.

- Exchanges also employ cold storage solutions to store the majority of funds offline, making them less vulnerable to hacking attempts.

- Regular security audits and penetration testing are conducted to identify and address any vulnerabilities in the exchange’s systems.

- Encryption techniques are used to secure user data and communications, ensuring that sensitive information remains confidential.

Despite these security measures, it is important for users to take additional precautions to protect their assets. This includes using unique and complex passwords, enabling 2FA, and being cautious of phishing attempts and fraudulent websites.