Risk Management Techniques for Crypto Investors

- Understanding the importance of risk management in cryptocurrency investments

- Setting clear investment goals and risk tolerance levels

- Diversifying your cryptocurrency portfolio to minimize risk

- Implementing stop-loss orders and profit-taking strategies

- Staying informed about market trends and news updates

- Seeking professional advice and guidance from financial experts

Understanding the importance of risk management in cryptocurrency investments

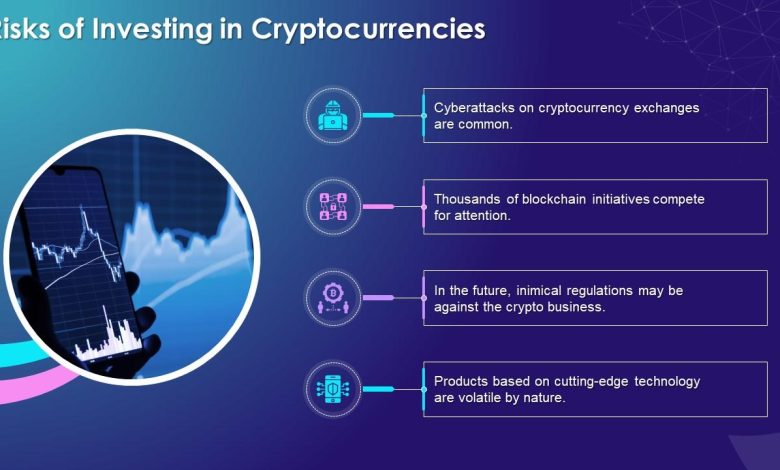

Understanding the significance of risk management in cryptocurrency investments is crucial for investors looking to navigate the volatile market successfully. Cryptocurrencies are known for their price fluctuations, which can lead to significant gains or losses in a short period. By implementing effective risk management techniques, investors can mitigate potential losses and protect their investment capital.

One key aspect of risk management in cryptocurrency investments is diversification. By spreading investments across different cryptocurrencies, investors can reduce the impact of a single asset’s price movement on their overall portfolio. Diversification helps to minimize risk exposure and increase the chances of achieving a more stable return on investment.

Another important risk management technique is setting stop-loss orders. Stop-loss orders allow investors to automatically sell a cryptocurrency when its price reaches a predetermined level, limiting potential losses. This strategy helps investors avoid emotional decision-making during market fluctuations and ensures that they stick to their investment plan.

Additionally, conducting thorough research and staying informed about market trends can help investors make more informed decisions and reduce the risk of making impulsive trades. By staying up-to-date with the latest news and developments in the cryptocurrency space, investors can better anticipate market movements and adjust their investment strategies accordingly.

In conclusion, risk management plays a vital role in cryptocurrency investments. By diversifying their portfolio, setting stop-loss orders, and staying informed about market trends, investors can protect their capital and increase their chances of achieving long-term success in the cryptocurrency market.

Setting clear investment goals and risk tolerance levels

When it comes to managing risks in the world of cryptocurrency investments, it is crucial to set clear investment goals and determine your risk tolerance levels. This will help you make informed decisions and avoid emotional reactions to market fluctuations. By establishing specific objectives for your investments, you can stay focused on your long-term financial goals and avoid making impulsive decisions based on short-term market trends.

Understanding your risk tolerance levels is equally important as it will help you determine how much volatility you can handle in your investment portfolio. By assessing your risk tolerance, you can create a diversified portfolio that aligns with your comfort level and financial objectives. This will help you avoid taking on too much risk or being overly conservative in your investment approach.

By setting clear investment goals and understanding your risk tolerance levels, you can develop a well-defined investment strategy that will guide your decision-making process. This will help you navigate the unpredictable nature of the cryptocurrency market and make informed choices that are in line with your financial objectives. Remember, managing risks is an essential part of successful investing, especially in the volatile world of cryptocurrencies.

Diversifying your cryptocurrency portfolio to minimize risk

Diversifying your cryptocurrency portfolio is a crucial risk management technique for crypto investors. By spreading your investments across different cryptocurrencies, you can minimize the impact of a potential downturn in any single asset. This strategy helps to protect your overall investment from significant losses.

When diversifying your portfolio, consider investing in a mix of cryptocurrencies with varying levels of market capitalization and utility. This can help you balance the potential risks and rewards associated with different assets. Additionally, you may want to include stablecoins or other less volatile cryptocurrencies to further reduce your overall risk exposure.

Furthermore, diversification can also involve investing in cryptocurrency projects from different sectors or industries. For example, you could allocate a portion of your portfolio to DeFi tokens, while also investing in privacy coins or platform tokens. This approach can help you hedge against sector-specific risks and take advantage of opportunities in multiple areas of the crypto market.

Implementing stop-loss orders and profit-taking strategies

Implementing stop-loss orders and profit-taking strategies is crucial for crypto investors to manage their risk effectively. By setting stop-loss orders, investors can automatically sell their crypto assets if the price drops to a certain level, preventing further losses. On the other hand, profit-taking strategies involve selling a portion of crypto holdings when the price reaches a certain target, locking in profits.

One common stop-loss strategy is to set the stop-loss order just below a key support level to minimize losses in case of a sudden price drop. This approach helps investors avoid emotional decision-making during market volatility. Additionally, profit-taking strategies can be implemented by selling a percentage of crypto assets when the price increases by a certain percentage, ensuring that investors secure profits along the way.

It is essential for crypto investors to regularly review and adjust their stop-loss orders and profit-taking strategies based on market conditions and price movements. By staying disciplined and sticking to their predetermined risk management plan, investors can protect their capital and optimize their returns in the volatile crypto market.

Staying informed about market trends and news updates

Staying informed about market trends and news updates is crucial for crypto investors looking to effectively manage their risks. By keeping a close eye on the latest developments in the cryptocurrency market, investors can make more informed decisions and react quickly to any changes that may impact their investments.

One way to stay informed is to regularly check reputable crypto news websites and blogs that provide up-to-date information on market trends and analysis. These sources can help investors stay ahead of the curve and anticipate potential market movements.

Additionally, following influential figures in the cryptocurrency community on social media platforms like Twitter and LinkedIn can provide valuable insights and investment tips. Engaging with other crypto investors in online forums and discussion groups can also help investors gain different perspectives and stay informed about market trends.

Seeking professional advice and guidance from financial experts

Seeking professional advice and guidance from financial experts is crucial for crypto investors looking to effectively manage risks in their investment portfolios. Financial experts have the knowledge and experience to help investors navigate the volatile and unpredictable nature of the cryptocurrency market. By consulting with professionals, investors can gain valuable insights into risk management techniques that can help protect their investments and maximize returns.

Financial experts can provide personalized advice based on an investor’s risk tolerance, investment goals, and market conditions. They can help investors develop a diversified portfolio that spreads risk across different assets and sectors. Additionally, financial experts can offer guidance on when to buy or sell assets to minimize losses and maximize profits. By working with professionals, investors can make informed decisions that are aligned with their financial objectives.

Furthermore, financial experts can help investors stay informed about regulatory changes, market trends, and emerging technologies in the cryptocurrency space. This knowledge can help investors anticipate potential risks and opportunities, allowing them to adjust their investment strategies accordingly. By staying ahead of the curve, investors can position themselves for success in the ever-changing crypto market.