Comparing Different Cryptocurrency Exchanges

- Understanding the Basics of Cryptocurrency Exchanges

- Key Factors to Consider When Choosing a Cryptocurrency Exchange

- Comparing Fees and Trading Options Across Various Exchanges

- Security Measures: How Different Exchanges Protect Your Assets

- User Experience: Navigating Different Cryptocurrency Exchange Platforms

- Regulatory Compliance: How Exchanges Differ in Terms of Regulations

Understanding the Basics of Cryptocurrency Exchanges

Cryptocurrency exchanges are online platforms where users can buy, sell, and trade various cryptocurrencies. These exchanges act as intermediaries, matching buyers with sellers and facilitating transactions. It is essential to understand the basics of cryptocurrency exchanges before diving into the world of digital assets.

One key concept to grasp is the difference between centralized and decentralized exchanges. Centralized exchanges are operated by a single entity and require users to deposit their funds into the exchange’s wallet. On the other hand, decentralized exchanges allow users to retain control of their funds and conduct peer-to-peer transactions directly.

When choosing a cryptocurrency exchange, it is crucial to consider factors such as security, fees, liquidity, and user experience. Security should be a top priority, as exchanges are frequent targets for hackers. Look for exchanges that offer two-factor authentication and cold storage for funds.

Fees can vary significantly between exchanges, so be sure to compare fee structures before making a decision. High liquidity is essential for smooth trading, as it ensures that there are enough buyers and sellers to facilitate transactions. A user-friendly interface can also make a significant difference in your trading experience.

Overall, understanding the basics of cryptocurrency exchanges is essential for anyone looking to enter the world of digital assets. By considering factors such as security, fees, liquidity, and user experience, you can choose an exchange that meets your needs and helps you navigate the exciting world of cryptocurrencies.

Key Factors to Consider When Choosing a Cryptocurrency Exchange

When selecting a cryptocurrency exchange, there are several key factors to take into consideration to ensure you are making the best choice for your needs. These factors can greatly impact your overall trading experience and the security of your investments. Here are some important aspects to keep in mind:

– **Security**: One of the most crucial factors to consider when choosing a cryptocurrency exchange is the level of security it offers. Look for exchanges that have robust security measures in place, such as two-factor authentication and cold storage for funds.

– **Fees**: Another important consideration is the fee structure of the exchange. Different exchanges have varying fee schedules for trading, deposits, and withdrawals. Make sure to compare these fees across different platforms to find one that aligns with your budget.

– **Liquidity**: Liquidity is essential for smooth trading on an exchange. Higher liquidity means there are more buyers and sellers on the platform, which can result in better prices and faster transactions. Consider the trading volume of the exchange before making your decision.

– **User Interface**: The user interface of an exchange can greatly impact your trading experience. Look for an exchange that is easy to navigate and offers the tools and features you need to make informed trading decisions.

– **Customer Support**: In the world of cryptocurrency, issues can arise at any time. It is important to choose an exchange that offers reliable customer support to assist you with any problems or questions you may have.

– **Regulation**: Regulatory compliance is crucial when choosing a cryptocurrency exchange. Look for exchanges that are licensed and regulated in your jurisdiction to ensure the safety of your funds and compliance with legal requirements.

By considering these key factors when choosing a cryptocurrency exchange, you can make an informed decision that aligns with your trading goals and priorities. Take the time to research and compare different exchanges to find the one that best meets your needs.

Comparing Fees and Trading Options Across Various Exchanges

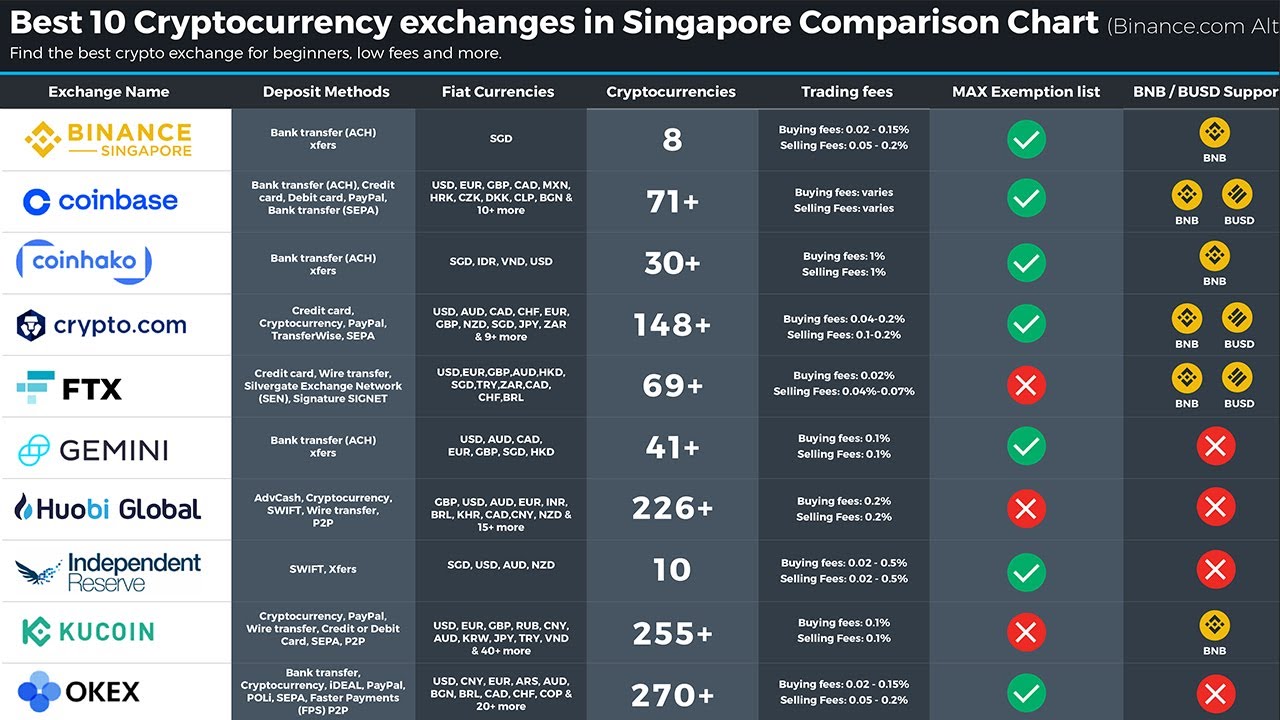

When comparing fees and trading options across different cryptocurrency exchanges, it is essential to consider various factors that can impact your overall trading experience. Some exchanges may offer lower fees but have limited trading options, while others may have higher fees but provide a wider range of cryptocurrencies to trade.

One important aspect to consider is the fee structure of each exchange. Some exchanges charge a flat fee per trade, while others may have a tiered fee structure based on the trading volume. It is crucial to calculate how these fees will impact your trading strategy and overall profitability.

In addition to fees, you should also consider the trading options available on each exchange. Some exchanges may offer a wide range of cryptocurrencies to trade, while others may have a more limited selection. It is essential to choose an exchange that aligns with your trading goals and preferences.

Furthermore, you should also consider the liquidity of each exchange. Higher liquidity means that there are more buyers and sellers on the platform, which can result in tighter spreads and better execution prices. It is crucial to choose an exchange with high liquidity to ensure a smooth trading experience.

Overall, when comparing fees and trading options across various exchanges, it is essential to consider a combination of factors such as fee structure, trading options, and liquidity. By carefully evaluating these factors, you can choose an exchange that best suits your trading needs and preferences.

Security Measures: How Different Exchanges Protect Your Assets

When it comes to choosing a cryptocurrency exchange, one of the most important factors to consider is the security measures in place to protect your assets. Different exchanges employ various security protocols to safeguard your funds from potential threats. Here is a comparison of how some of the top exchanges protect your assets:

- Encryption: Many exchanges use advanced encryption techniques to secure your data and transactions. This helps prevent unauthorized access to your account and keeps your information safe from hackers.

- Two-Factor Authentication (2FA): Most exchanges offer 2FA as an extra layer of security. This requires you to provide a second form of verification, such as a code sent to your phone, in addition to your password when logging in or making transactions.

- Cold Storage: Some exchanges store the majority of their users’ funds in offline cold wallets, which are not connected to the internet. This makes it much harder for hackers to access these funds compared to hot wallets, which are online and more vulnerable to attacks.

- Insurance: A few exchanges offer insurance coverage in case of a security breach or hack that results in the loss of funds. This provides an extra layer of protection and peace of mind for users.

- Regular Security Audits: Many exchanges conduct regular security audits by third-party firms to identify and address any vulnerabilities in their systems. This helps ensure that the exchange is up to date with the latest security measures.

By understanding how different exchanges protect your assets, you can make an informed decision on which platform to use based on your security preferences and risk tolerance. Remember to always prioritize security when choosing a cryptocurrency exchange to safeguard your investments.

User Experience: Navigating Different Cryptocurrency Exchange Platforms

When it comes to navigating different cryptocurrency exchange platforms, users may find themselves overwhelmed by the sheer number of options available in the market. Each platform offers its own unique features, user interface, and trading experience. To help users make an informed decision, it is essential to compare and contrast these platforms based on various factors.

One of the key aspects to consider when evaluating cryptocurrency exchanges is the user experience. This includes factors such as ease of use, speed of transactions, security measures, and customer support. Some platforms may offer a more intuitive interface, making it easier for beginners to navigate and execute trades. Others may prioritize security features to protect users’ assets from potential threats.

Furthermore, the speed of transactions is crucial for traders looking to capitalize on market opportunities quickly. A platform that offers fast transaction times can give users a competitive edge in the volatile cryptocurrency market. Additionally, reliable customer support can help users resolve any issues or concerns they may encounter while using the platform.

By comparing different cryptocurrency exchange platforms based on these factors, users can determine which platform best suits their needs and preferences. Whether they prioritize ease of use, security, speed, or customer support, there is a platform out there that can meet their requirements. Ultimately, the goal is to find a platform that offers a seamless and enjoyable trading experience for users of all levels of expertise.

Regulatory Compliance: How Exchanges Differ in Terms of Regulations

When it comes to regulatory compliance, different cryptocurrency exchanges vary in terms of the regulations they adhere to. It is essential for traders to understand the regulatory environment of the exchanges they are using to ensure the safety and security of their investments. Some exchanges may operate in regions with strict regulatory frameworks, while others may be more lenient in their approach.

One key aspect to consider is the level of Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures that exchanges have in place. Exchanges that have robust KYC and AML measures are generally considered more trustworthy and secure. These measures help prevent fraudulent activities and ensure that users are who they claim to be.

Additionally, some exchanges may be registered with regulatory authorities in their respective jurisdictions, while others may operate without any formal oversight. Registered exchanges are typically required to comply with specific rules and regulations set forth by the regulatory bodies, providing an extra layer of protection for traders.

It is crucial for traders to research and compare the regulatory compliance of different exchanges before deciding which one to use. By understanding the regulatory environment of each exchange, traders can make informed decisions and mitigate potential risks associated with trading cryptocurrencies. Ultimately, choosing an exchange that prioritizes regulatory compliance can help ensure a safe and secure trading experience for all users.