The History and Evolution of Bitcoin

- The Origins of Bitcoin

- The Rise of Cryptocurrency

- Key Events in Bitcoin’s History

- Bitcoin’s Impact on the Financial World

- Challenges and Controversies Surrounding Bitcoin

- The Future of Bitcoin and Cryptocurrency

The Origins of Bitcoin

Bitcoin was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. The origins of Bitcoin can be traced back to a whitepaper published by Nakamoto titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This whitepaper outlined the concept of a decentralized digital currency that would allow for peer-to-peer transactions without the need for a central authority.

The creation of Bitcoin was a response to the financial crisis of 2008, which highlighted the shortcomings of the traditional banking system. Nakamoto’s vision was to create a currency that was not controlled by any government or financial institution, providing users with greater financial freedom and privacy.

One of the key innovations of Bitcoin was the use of blockchain technology, a decentralized and transparent ledger that records all transactions made with the cryptocurrency. This technology ensures the security and integrity of the Bitcoin network, making it resistant to fraud and tampering.

Bitcoin quickly gained popularity among tech-savvy individuals and those looking for an alternative to traditional banking systems. Its value began to rise, attracting investors and speculators who saw the potential for significant returns. Over the years, Bitcoin has gone through periods of volatility but has continued to gain mainstream acceptance as a legitimate form of currency.

Today, Bitcoin is used for a wide range of transactions, from online purchases to remittances and investments. Its decentralized nature and limited supply have made it a popular choice for those seeking financial independence and autonomy. As the first and most well-known cryptocurrency, Bitcoin has paved the way for the development of thousands of other digital currencies, collectively known as altcoins.

The Rise of Cryptocurrency

The rise of cryptocurrency marked a significant shift in the financial landscape, introducing a new form of digital currency that operates independently of traditional banking systems. Bitcoin, the first cryptocurrency, was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Since then, Bitcoin has gained widespread popularity and has paved the way for the development of thousands of other cryptocurrencies.

One of the key features of cryptocurrency is its decentralized nature, meaning that it is not controlled by any central authority such as a government or financial institution. Transactions are recorded on a public ledger called the blockchain, which ensures transparency and security. This technology has revolutionized the way we think about money and has the potential to disrupt traditional financial systems.

As more people began to adopt cryptocurrency, its value started to soar. Bitcoin, in particular, experienced massive price fluctuations, attracting both investors and speculators. The concept of mining, where individuals use powerful computers to solve complex mathematical equations and validate transactions, became a lucrative industry.

Despite its growing popularity, cryptocurrency has faced challenges such as regulatory scrutiny, security concerns, and volatility. However, many believe that it has the potential to revolutionize the way we transact and store value. The rise of cryptocurrency has sparked a global conversation about the future of money and finance, with many experts predicting that it will continue to shape the financial landscape for years to come.

Key Events in Bitcoin’s History

Bitcoin has had several key events in its history that have shaped its evolution and trajectory. One of the most significant events was the creation of Bitcoin in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. This event marked the beginning of the cryptocurrency revolution and laid the foundation for the decentralized digital currency we know today.

Another important event in Bitcoin’s history was the first real-world transaction using Bitcoin in 2010 when a programmer named Laszlo Hanyecz purchased two pizzas for 10,000 Bitcoins. This event demonstrated the potential of Bitcoin as a medium of exchange and sparked interest in its use as a currency.

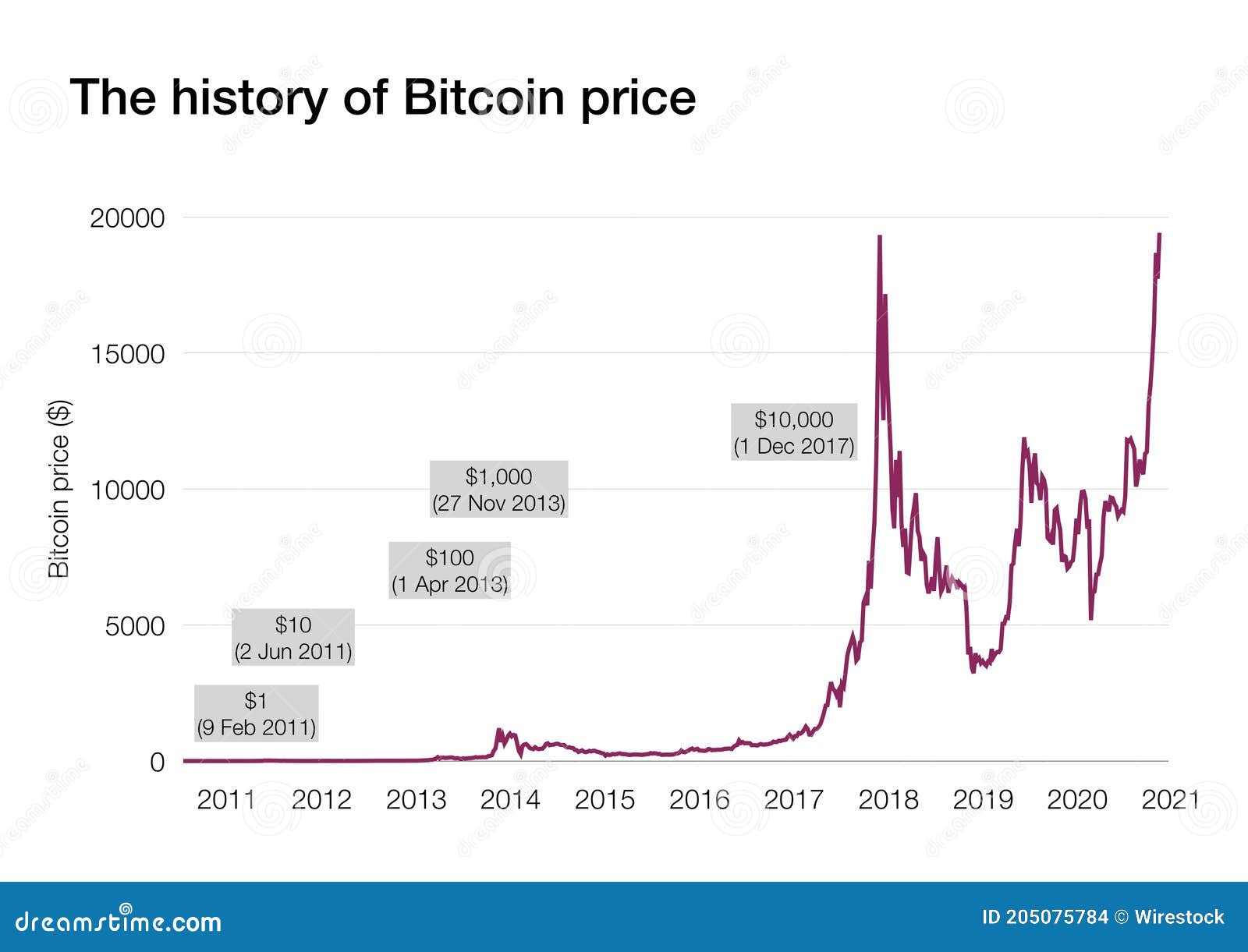

In 2013, Bitcoin experienced a major price rally, reaching over $1,000 per Bitcoin for the first time. This event brought Bitcoin into the mainstream spotlight and attracted a new wave of investors and users to the cryptocurrency market.

The year 2017 saw another significant event in Bitcoin’s history with the creation of Bitcoin Cash, a hard fork of the original Bitcoin blockchain. This event highlighted the scalability issues facing Bitcoin and led to the creation of alternative cryptocurrencies with different approaches to solving these issues.

In 2020, Bitcoin experienced a significant milestone with its third halving event, which reduced the block reward for miners in half. This event highlighted Bitcoin’s deflationary nature and its scarcity as a digital asset, leading to increased interest from institutional investors and mainstream adoption.

Overall, these key events in Bitcoin’s history have played a crucial role in shaping its development and adoption as a digital currency. From its creation in 2009 to its most recent halving event in 2020, Bitcoin has continued to evolve and grow, solidifying its position as the leading cryptocurrency in the market.

Bitcoin’s Impact on the Financial World

Bitcoin has had a significant impact on the financial world since its inception in 2009. This digital currency has revolutionized the way people think about money and transactions. One of the key aspects of Bitcoin is its decentralized nature, which means that it is not controlled by any government or financial institution. This has led to increased financial freedom for individuals who want to transact without the need for intermediaries.

Moreover, Bitcoin has also introduced the concept of blockchain technology, which is a decentralized and secure way of recording transactions. This technology has the potential to disrupt various industries beyond finance, such as supply chain management and voting systems. The transparency and immutability of the blockchain make it an attractive option for businesses looking to streamline their operations and increase trust among their customers.

Additionally, Bitcoin has opened up new opportunities for investment and speculation. Many people have made significant profits by buying and selling Bitcoin, while others have lost money due to its volatile nature. Despite the risks involved, Bitcoin has become a popular asset class for investors looking to diversify their portfolios and hedge against traditional financial markets.

Overall, Bitcoin’s impact on the financial world has been profound and far-reaching. It has challenged the traditional banking system and forced regulators to rethink their approach to digital currencies. As Bitcoin continues to evolve and gain mainstream acceptance, its influence on the financial landscape is likely to grow even further in the coming years.

Challenges and Controversies Surrounding Bitcoin

Bitcoin has faced numerous challenges and controversies throughout its history, which have shaped its evolution and adoption. One of the main challenges surrounding Bitcoin is its volatility, with prices fluctuating wildly over short periods. This has led to concerns about its use as a stable store of value and medium of exchange. Additionally, Bitcoin has been criticized for its potential use in illegal activities such as money laundering and tax evasion.

Another controversy surrounding Bitcoin is its environmental impact. The process of mining Bitcoin requires a significant amount of energy, leading to concerns about its carbon footprint. Critics argue that the energy consumption associated with Bitcoin mining is unsustainable and contributes to climate change. This has sparked debates within the cryptocurrency community about the need for more sustainable mining practices.

Regulatory challenges have also been a major issue for Bitcoin. Governments around the world have struggled to develop a coherent regulatory framework for cryptocurrencies, leading to uncertainty for users and businesses. Some countries have banned or restricted the use of Bitcoin, while others have embraced it as a legitimate form of payment. This regulatory uncertainty has hindered the mainstream adoption of Bitcoin and other cryptocurrencies.

Despite these challenges and controversies, Bitcoin continues to grow in popularity and acceptance. Its decentralized nature and potential for financial innovation have attracted a loyal following of users and developers. As the technology behind Bitcoin continues to evolve, it is likely that these challenges will be addressed and overcome, paving the way for a more stable and sustainable future for the cryptocurrency.

The Future of Bitcoin and Cryptocurrency

The future of Bitcoin and cryptocurrency is filled with both excitement and uncertainty. As Bitcoin continues to gain mainstream acceptance and adoption, many experts believe that the value of cryptocurrencies will only continue to rise. However, there are also concerns about the regulatory environment surrounding cryptocurrency and how it may impact the future of Bitcoin and other digital assets.

One of the key factors that will shape the future of Bitcoin and cryptocurrency is the development of new technologies and innovations in the space. For example, the rise of decentralized finance (DeFi) has the potential to revolutionize the way we think about traditional financial systems. Additionally, advancements in blockchain technology could make Bitcoin and other cryptocurrencies even more secure and efficient.

Another important consideration for the future of Bitcoin is how it will be affected by global economic trends and geopolitical events. As governments around the world grapple with issues such as inflation and economic instability, many people are turning to Bitcoin as a hedge against traditional financial systems. This could lead to increased adoption of cryptocurrency as a store of value and means of exchange.

In conclusion, the future of Bitcoin and cryptocurrency is still uncertain, but there is no denying that these digital assets have the potential to revolutionize the way we think about money and finance. As technology continues to evolve and the world becomes more interconnected, Bitcoin and cryptocurrency could play an increasingly important role in our lives.