When to Buy and Sell: Timing the Crypto Market

- Understanding market cycles in the crypto world

- Key indicators to watch for when timing your crypto trades

- The psychology behind buying and selling in the crypto market

- Strategies for maximizing profits through market timing

- Common mistakes to avoid when trying to time the crypto market

- Expert advice on when to buy and sell in the volatile world of cryptocurrencies

Understanding market cycles in the crypto world

Understanding market cycles in the crypto world is crucial for making informed decisions on when to buy and sell digital assets. Market cycles refer to the recurring patterns of price movements in the cryptocurrency market. By analyzing these cycles, investors can identify potential opportunities to enter or exit the market.

One of the most common market cycles in the crypto world is the bull and bear cycle. During a bull market, prices are on the rise, and investor sentiment is positive. This is typically a good time to buy digital assets as prices are expected to continue increasing. On the other hand, a bear market is characterized by falling prices and negative sentiment. Selling during a bear market can help investors minimize losses.

Another important market cycle to consider is the accumulation and distribution phase. During the accumulation phase, prices are relatively stable, and smart money investors are buying assets at lower prices. This is a good time for retail investors to accumulate digital assets before prices start to rise. The distribution phase, on the other hand, is when smart money investors start selling their holdings, causing prices to decline.

Key indicators to watch for when timing your crypto trades

When it comes to timing your crypto trades, there are several key indicators to keep an eye on. These indicators can help you make more informed decisions about when to buy and sell your cryptocurrencies. By paying attention to these signals, you can increase your chances of success in the volatile crypto market.

- Market Trends: One of the most important indicators to watch is market trends. By analyzing the overall direction of the market, you can get a sense of whether prices are likely to go up or down in the near future.

- Trading Volume: Another key indicator is trading volume. High trading volume can indicate increased interest in a particular cryptocurrency, which may lead to price movements.

- Price Patterns: Paying attention to price patterns can also be helpful. Patterns such as head and shoulders, double tops, and triangles can provide insights into potential price movements.

- Support and Resistance Levels: Support and resistance levels are price points at which a cryptocurrency tends to stop and reverse. By identifying these levels, you can make more strategic trading decisions.

- Market Sentiment: Lastly, market sentiment can play a significant role in crypto trading. Positive or negative news, social media buzz, and investor sentiment can all impact the price of a cryptocurrency.

By keeping an eye on these key indicators, you can better time your crypto trades and improve your chances of success in the market. Remember to do your own research and consider multiple factors before making any trading decisions.

The psychology behind buying and selling in the crypto market

Understanding the psychology behind buying and selling in the crypto market is crucial for making informed decisions. Investors often experience emotions such as fear, greed, and FOMO (fear of missing out) when trading cryptocurrencies. These emotions can lead to impulsive decisions that may not be based on rational analysis.

When it comes to buying, investors may feel the urge to jump on the bandwagon when prices are rising rapidly. This behavior is driven by the fear of missing out on potential profits. However, it is essential to remember that markets are volatile, and prices can fluctuate quickly. It is crucial to conduct thorough research and analysis before making any investment decisions.

On the other hand, selling can be equally challenging for investors. When prices are falling, investors may panic and sell their assets to avoid further losses. This behavior is driven by fear and can lead to selling at a loss. It is essential to remain calm and rational during market downturns and not make decisions based on emotions.

Successful investors in the crypto market are those who can control their emotions and make decisions based on logic and analysis. By understanding the psychology behind buying and selling, investors can avoid common pitfalls and make more informed decisions. It is essential to have a clear investment strategy and stick to it, regardless of market fluctuations.

Strategies for maximizing profits through market timing

One effective strategy for maximizing profits through market timing in the crypto market is to closely monitor trends and patterns. By staying informed about the latest developments in the market, investors can make more informed decisions about when to buy and sell their assets. Additionally, it is essential to set clear profit targets and stop-loss orders to protect investments and ensure that profits are not eroded by sudden market fluctuations.

Another key strategy is to diversify your portfolio to spread risk and maximize potential returns. By investing in a variety of cryptocurrencies, investors can reduce their exposure to any single asset and increase the likelihood of profiting from overall market growth. It is also important to regularly review and adjust your portfolio to reflect changing market conditions and opportunities.

Furthermore, it can be beneficial to use technical analysis tools and indicators to identify potential entry and exit points in the market. By analyzing price charts and market data, investors can gain valuable insights into market trends and make more strategic decisions about when to buy and sell their assets. Additionally, it is crucial to stay disciplined and avoid making emotional decisions based on fear or greed.

Overall, by implementing these strategies and staying informed about market trends, investors can increase their chances of maximizing profits through market timing in the crypto market. It is essential to approach trading with a clear plan and to continuously educate oneself about the market to make informed decisions and achieve long-term success.

Common mistakes to avoid when trying to time the crypto market

When trying to time the crypto market, there are several common mistakes that investors should avoid in order to maximize their chances of success. One of the most common mistakes is trying to predict short-term price movements based on emotions or hype. This can lead to impulsive decisions that result in losses. Instead, it is important to focus on long-term trends and fundamentals when making investment decisions.

Another mistake to avoid is overtrading. Some investors try to time the market by constantly buying and selling cryptocurrencies in an attempt to profit from short-term price fluctuations. However, this can result in high transaction fees and taxes, which can eat into profits. It is important to have a clear investment strategy and stick to it, rather than constantly reacting to market movements.

Additionally, it is important to avoid following the crowd when trying to time the crypto market. Just because everyone else is buying or selling a particular coin does not mean it is the right decision for you. It is important to do your own research and make informed decisions based on your own financial goals and risk tolerance.

Lastly, it is crucial to avoid timing the market based on news or rumors. The crypto market is highly volatile and can be easily influenced by external factors. Instead of trying to react to every piece of news, it is important to have a long-term perspective and focus on the underlying value of the cryptocurrency you are investing in.

Expert advice on when to buy and sell in the volatile world of cryptocurrencies

When it comes to navigating the unpredictable world of cryptocurrencies, seeking expert advice on the optimal timing for buying and selling can be invaluable. With the market constantly fluctuating, knowing when to make a move can make all the difference in maximizing profits and minimizing losses.

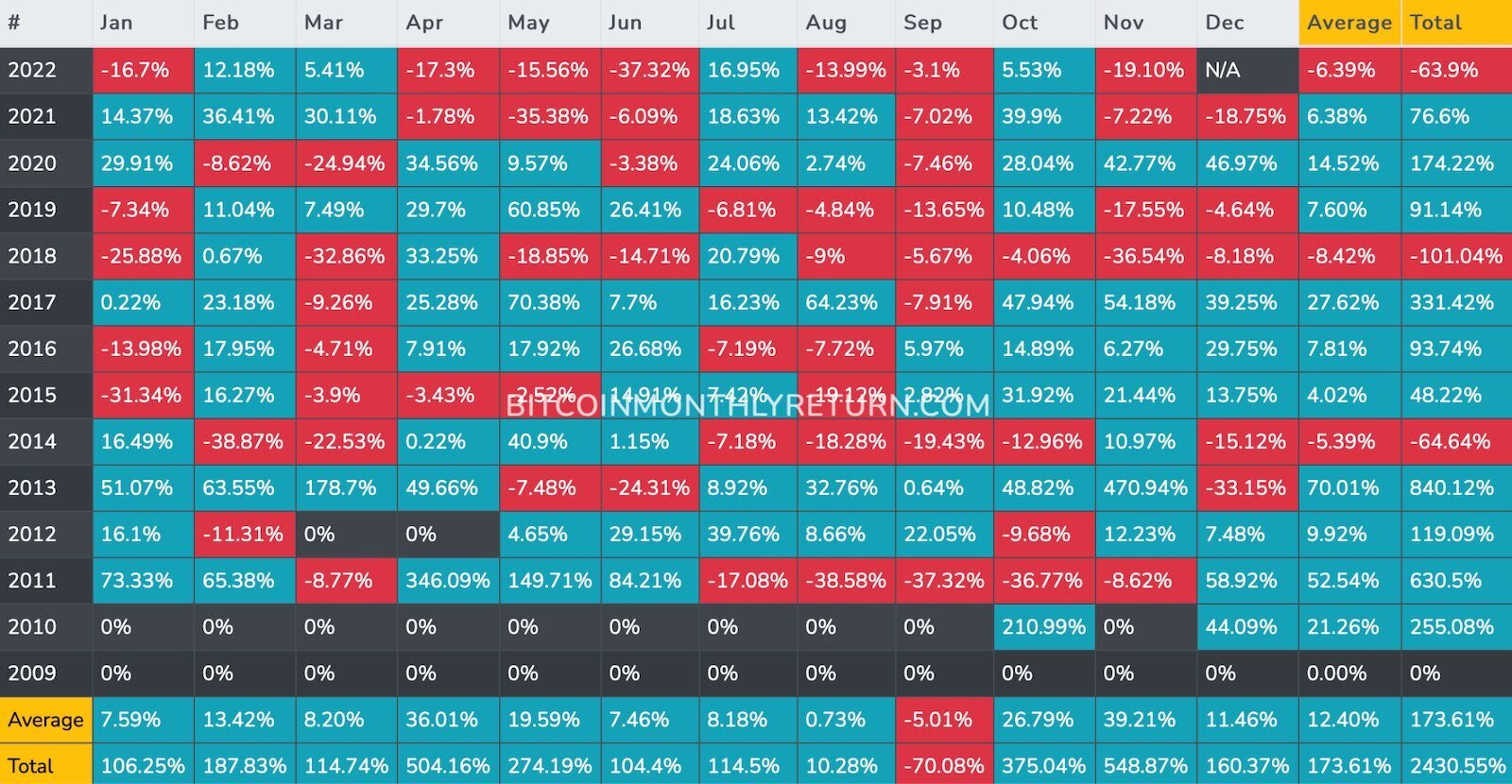

One key piece of advice from experts is to analyze market trends and identify patterns that can help determine the best times to buy and sell. By studying historical data and keeping an eye on current market conditions, investors can gain valuable insights into when prices are likely to rise or fall.

Another important factor to consider is setting clear goals and establishing a solid strategy before making any trades. Whether you’re looking to make a quick profit or hold onto your investments for the long term, having a plan in place can help you make more informed decisions and avoid making impulsive moves.

It’s also crucial to stay informed about the latest news and developments in the cryptocurrency world. External factors such as regulatory changes, technological advancements, and market sentiment can all have a significant impact on prices. By keeping up with the latest information, you can adjust your strategy accordingly and make more strategic decisions.

Ultimately, there is no foolproof way to predict the ups and downs of the crypto market with absolute certainty. However, by educating yourself, seeking advice from experts, and staying informed, you can increase your chances of making smart investment decisions and navigating the volatile world of cryptocurrencies more effectively.