The Impact of Global Events on Cryptocurrency Prices

- Understanding the relationship between major global events and cryptocurrency price fluctuations

- How geopolitical tensions can influence the value of digital currencies

- The role of economic indicators in predicting cryptocurrency market movements

- Exploring the impact of natural disasters on the volatility of cryptocurrencies

- Analyzing the correlation between stock market crashes and changes in cryptocurrency prices

- The effects of regulatory decisions and policy changes on the cryptocurrency market

Understanding the relationship between major global events and cryptocurrency price fluctuations

Understanding the relationship between major global events and cryptocurrency price fluctuations is crucial for investors and traders in the digital asset market. Various factors such as geopolitical tensions, economic indicators, regulatory developments, and even natural disasters can impact the value of cryptocurrencies. For example, when there is uncertainty in the global economy, investors tend to flock to safe-haven assets like Bitcoin, leading to an increase in its price. On the other hand, negative news such as regulatory crackdowns or security breaches can cause a drop in cryptocurrency prices.

It is essential to stay informed about current events and how they might affect the cryptocurrency market. By analyzing the correlation between global events and price movements, investors can make more informed decisions about when to buy or sell their digital assets. Additionally, understanding the underlying reasons behind price fluctuations can help predict future trends and mitigate risks in a volatile market.

Overall, the impact of global events on cryptocurrency prices is undeniable. By keeping a close eye on the news and staying informed about geopolitical, economic, and regulatory developments, investors can navigate the digital asset market more effectively. While price fluctuations are inevitable in the world of cryptocurrencies, having a solid understanding of the relationship between global events and market trends can help investors make better decisions and maximize their profits.

How geopolitical tensions can influence the value of digital currencies

Geopolitical tensions have a significant impact on the value of digital currencies. When there is instability in the global political landscape, investors tend to flock to alternative assets such as cryptocurrencies as a safe haven. This increased demand can drive up the prices of digital currencies, making them more valuable in times of uncertainty.

On the other hand, geopolitical tensions can also have a negative effect on the value of digital currencies. If a major world power imposes sanctions on a country or if there is a conflict that disrupts global trade, it can lead to a decrease in the value of cryptocurrencies. Investors may become wary of investing in digital assets during times of heightened geopolitical risk, causing prices to fall.

Overall, it is important for investors to keep an eye on geopolitical events and how they may impact the value of digital currencies. By staying informed and understanding the relationship between global events and cryptocurrency prices, investors can make more informed decisions about when to buy or sell their digital assets.

The role of economic indicators in predicting cryptocurrency market movements

Economic indicators play a crucial role in predicting movements in the cryptocurrency market. These indicators provide valuable insights into the overall health of the economy, which in turn can impact the prices of cryptocurrencies. By analyzing key economic indicators such as GDP growth, unemployment rates, inflation, and interest rates, investors and traders can gain a better understanding of the market dynamics and make more informed decisions.

For example, a strong GDP growth rate is often associated with increased consumer spending and investment, which can lead to higher demand for cryptocurrencies. On the other hand, rising unemployment rates or high inflation may signal economic instability, causing investors to flock to cryptocurrencies as a safe haven asset. Similarly, changes in interest rates set by central banks can also influence the value of cryptocurrencies, as they impact borrowing costs and investment returns.

By keeping a close eye on these economic indicators and understanding how they relate to the cryptocurrency market, investors can better anticipate price movements and adjust their trading strategies accordingly. While economic indicators are not the sole factor driving cryptocurrency prices, they provide valuable insights that can help investors navigate the volatile and unpredictable nature of the market.

Exploring the impact of natural disasters on the volatility of cryptocurrencies

Natural disasters have a significant impact on the volatility of cryptocurrencies. When a natural disaster strikes, it can cause panic among investors, leading to a sharp increase in the volatility of cryptocurrency prices. This heightened volatility is due to the uncertainty and fear that natural disasters bring, causing investors to make hasty decisions based on emotions rather than rational analysis.

The unpredictability of natural disasters can also lead to disruptions in the supply chain, affecting the production and distribution of goods and services. This disruption can have a ripple effect on the global economy, causing fluctuations in the value of traditional currencies and, consequently, cryptocurrencies. As a result, the prices of cryptocurrencies can experience sudden and drastic changes in response to natural disasters.

Moreover, natural disasters can impact the infrastructure that supports cryptocurrencies, such as mining operations and exchanges. For example, power outages or damage to mining facilities can affect the supply of new coins, leading to a decrease in mining activity and potentially driving up prices. Similarly, disruptions to cryptocurrency exchanges can hinder trading activities, further contributing to price volatility.

In conclusion, natural disasters play a crucial role in shaping the volatility of cryptocurrencies. Their unpredictable nature and widespread impact can create a sense of uncertainty in the market, prompting investors to react impulsively. As such, it is essential for cryptocurrency investors to consider the potential effects of natural disasters on the market and develop strategies to mitigate risks associated with increased volatility.

Analyzing the correlation between stock market crashes and changes in cryptocurrency prices

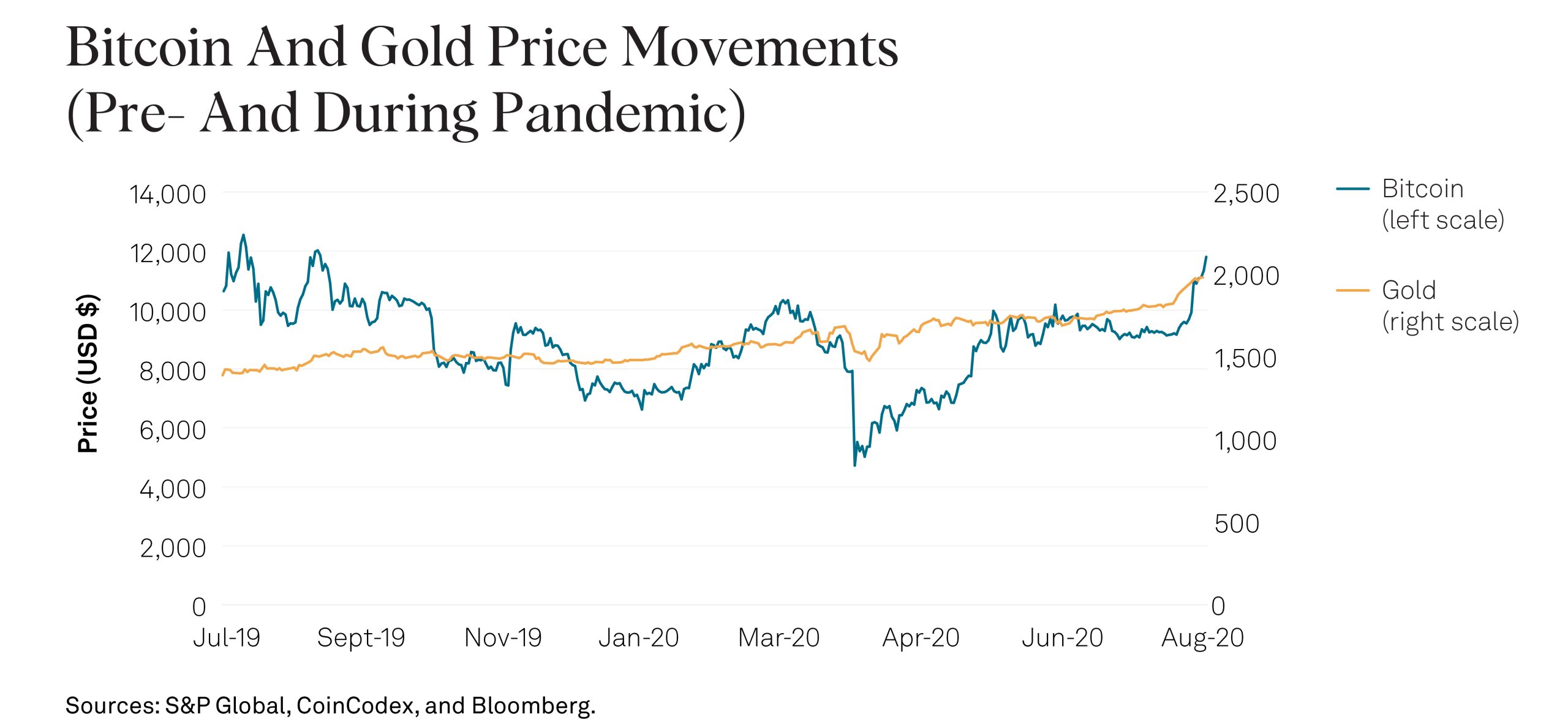

The correlation between stock market crashes and changes in cryptocurrency prices has been a topic of interest for many investors and analysts. When examining the impact of global events on cryptocurrency prices, it is essential to consider how traditional financial markets can influence the value of digital assets.

During times of economic uncertainty or market turmoil, investors often seek alternative assets such as cryptocurrencies as a hedge against traditional market risks. This flight to safety can lead to an increase in demand for cryptocurrencies, driving up their prices. Conversely, when stock markets experience a significant downturn, investors may liquidate their cryptocurrency holdings to cover losses in other areas of their portfolio, causing a drop in cryptocurrency prices.

It is crucial to note that the relationship between stock market crashes and cryptocurrency prices is not always straightforward. While there may be instances where both markets move in tandem, there are also times when they move in opposite directions. Factors such as market sentiment, regulatory developments, and technological advancements can all play a role in shaping the relationship between traditional and digital assets.

By analyzing the correlation between stock market crashes and changes in cryptocurrency prices, investors can gain valuable insights into how global events impact the cryptocurrency market. This information can help them make more informed decisions when managing their investment portfolios and navigating volatile market conditions.

The effects of regulatory decisions and policy changes on the cryptocurrency market

The effects of regulatory decisions and policy changes on the cryptocurrency market can have a significant impact on prices and investor sentiment. When governments announce new regulations or make changes to existing policies related to cryptocurrencies, it can create uncertainty and volatility in the market. This uncertainty often leads to fluctuations in prices as investors react to the news and adjust their positions accordingly.

Regulatory decisions can also influence the adoption of cryptocurrencies on a global scale. For example, if a major country were to ban or restrict the use of cryptocurrencies, it could have a domino effect on other nations and lead to a decrease in overall market demand. On the other hand, favorable regulatory decisions can boost confidence in the market and attract more investors, leading to an increase in prices.

It is essential for investors to stay informed about regulatory developments and policy changes that could impact the cryptocurrency market. By keeping a close eye on government announcements and understanding the potential implications, investors can make more informed decisions about when to buy or sell their digital assets.