Latest Regulatory Changes in the Crypto World

- Introduction to the evolving regulatory landscape in the crypto industry

- Key regulatory updates impacting the crypto market

- How new regulations are shaping the future of cryptocurrencies

- Compliance challenges faced by crypto businesses in light of regulatory changes

- Global perspectives on the changing regulatory environment for cryptocurrencies

- The impact of regulatory changes on investor sentiment towards crypto assets

Introduction to the evolving regulatory landscape in the crypto industry

The regulatory landscape in the crypto industry is constantly evolving, with governments around the world taking steps to address the challenges posed by digital currencies. These changes have a significant impact on how businesses operate in the crypto space, as they must navigate a complex web of regulations to ensure compliance. From anti-money laundering (AML) and know your customer (KYC) requirements to tax implications and securities laws, there are a myriad of issues that companies must consider when operating in the crypto industry.

One of the key trends in the regulatory landscape is the increasing focus on consumer protection. Regulators are keen to ensure that investors are not exposed to unnecessary risks when trading cryptocurrencies, and as such, they are implementing measures to safeguard the interests of consumers. This includes measures such as requiring exchanges to conduct thorough due diligence on their customers and implementing robust security measures to protect against hacks and fraud.

Another important development in the regulatory landscape is the growing recognition of cryptocurrencies as a legitimate asset class. As more institutional investors enter the market, regulators are working to create a framework that allows for the responsible trading of digital assets. This includes establishing guidelines for custody and reporting requirements, as well as ensuring that exchanges operate in a transparent and fair manner.

Overall, the evolving regulatory landscape in the crypto industry presents both challenges and opportunities for businesses operating in this space. By staying informed about the latest regulatory changes and working proactively to ensure compliance, companies can position themselves for long-term success in the rapidly changing world of cryptocurrencies.

Key regulatory updates impacting the crypto market

Recent regulatory changes have had a significant impact on the cryptocurrency market, shaping the way in which digital assets are bought, sold, and traded. It is crucial for investors and stakeholders to stay informed about these updates to navigate the evolving landscape of crypto regulations.

One key update that has garnered attention is the increased scrutiny from regulatory bodies on initial coin offerings (ICOs). Regulators are cracking down on fraudulent ICOs to protect investors from scams and ensure compliance with securities laws. This has led to a more cautious approach from companies looking to launch ICOs, as they must now adhere to stricter guidelines.

Another important development is the growing trend of governments around the world introducing their own central bank digital currencies (CBDCs). These digital currencies are issued and regulated by central banks, offering a government-backed alternative to decentralized cryptocurrencies. The rise of CBDCs could potentially impact the adoption and use of existing cryptocurrencies.

Furthermore, there has been a push for greater transparency and accountability in the crypto market, with regulators focusing on combating money laundering and terrorist financing through stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This shift towards more stringent compliance measures aims to legitimize the crypto industry and foster trust among investors.

Overall, these regulatory updates underscore the need for the crypto community to adapt to a rapidly changing regulatory environment. By staying informed and compliant with the latest regulations, stakeholders can help ensure the long-term sustainability and growth of the cryptocurrency market.

How new regulations are shaping the future of cryptocurrencies

Recent regulatory changes have had a significant impact on the future of cryptocurrencies. Governments around the world are implementing new rules and guidelines to regulate the use of digital assets. These regulations aim to protect investors, prevent fraud, and ensure the stability of the financial system.

One of the key areas of focus for regulators is the prevention of money laundering and terrorist financing through cryptocurrencies. By requiring exchanges and other service providers to implement know-your-customer (KYC) and anti-money laundering (AML) procedures, regulators hope to reduce the risk of illicit activities in the crypto space.

Another important aspect of the new regulations is the taxation of cryptocurrency transactions. Many countries are now requiring individuals and businesses to report their crypto holdings and pay taxes on any gains. This move towards greater transparency and accountability is seen as a positive step towards mainstream adoption of digital currencies.

Overall, the evolving regulatory landscape is shaping the future of cryptocurrencies in a number of ways. While some in the crypto community may see these changes as a challenge, others view them as an opportunity for the industry to mature and gain wider acceptance. As regulators continue to refine their approach to digital assets, it is clear that the crypto world is entering a new era of oversight and accountability.

Compliance challenges faced by crypto businesses in light of regulatory changes

Compliance challenges faced by cryptocurrency businesses have become more prevalent in recent years due to the evolving regulatory landscape. With the increasing scrutiny from regulators around the world, crypto companies are finding it difficult to navigate the complex web of rules and regulations.

One of the main challenges for crypto businesses is the lack of clarity in regulations, which can vary significantly from one jurisdiction to another. This makes it difficult for companies to ensure they are in compliance with all relevant laws and regulations, leading to potential legal risks and penalties.

Another challenge is the need for robust anti-money laundering (AML) and know your customer (KYC) procedures. Regulators are increasingly requiring crypto businesses to implement these measures to prevent illicit activities such as money laundering and terrorist financing.

Moreover, the rapid pace of technological innovation in the crypto space means that regulations are constantly playing catch-up. This creates uncertainty for businesses as they try to stay ahead of the curve while also complying with existing laws.

In conclusion, compliance challenges faced by crypto businesses in light of regulatory changes are significant and require careful navigation to ensure long-term success in the industry. By staying informed about the latest regulatory developments and implementing robust compliance measures, companies can mitigate risks and build trust with regulators and customers alike.

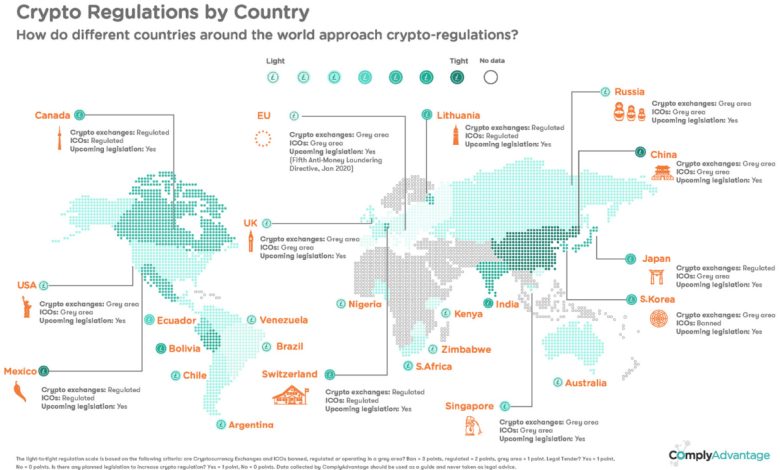

Global perspectives on the changing regulatory environment for cryptocurrencies

In recent years, there has been a significant shift in the regulatory landscape surrounding cryptocurrencies. Governments and regulatory bodies around the world are grappling with how to effectively regulate this rapidly evolving industry. **Global perspectives** on the changing regulatory environment for cryptocurrencies vary widely, with some countries embracing digital assets while others take a more cautious approach.

**Many** countries have started to implement regulations to protect investors and prevent illicit activities such as money laundering and fraud. **These** regulations often require cryptocurrency exchanges to adhere to know-your-customer (KYC) and anti-money laundering (AML) guidelines. **Additionally**, some countries have introduced licensing requirements for cryptocurrency businesses to operate legally.

**On** the other hand, some countries have taken a more restrictive stance on cryptocurrencies, banning their use altogether. **China**, for example, has cracked down on cryptocurrency trading and mining activities in recent years. **This** has led to a significant decrease in the use of cryptocurrencies in the country.

**Despite** the varying approaches to cryptocurrency regulation, one thing is clear: the regulatory environment for cryptocurrencies is constantly evolving. **It** is important for investors and businesses operating in this space to stay informed about the latest regulatory changes to ensure compliance with the law. **Failure** to do so could result in severe penalties or even the closure of a business.

**In** conclusion, the global regulatory environment for cryptocurrencies is complex and ever-changing. **It** is crucial for stakeholders in the industry to stay abreast of the latest developments and ensure compliance with regulations to avoid legal repercussions. **By** understanding the global perspectives on cryptocurrency regulation, businesses and investors can navigate this challenging landscape more effectively.

The impact of regulatory changes on investor sentiment towards crypto assets

Regulatory changes have a significant impact on investor sentiment towards crypto assets. When new regulations are introduced, investors may become more cautious or optimistic depending on how the changes are perceived. This can lead to fluctuations in the market as investors adjust their strategies to comply with the new rules.

For example, recent regulatory changes requiring stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures have caused some investors to feel more secure in their investments, while others may see it as an obstacle to their privacy. Additionally, regulations around taxation and reporting requirements can also influence how investors view the crypto market.

Overall, regulatory changes play a crucial role in shaping investor sentiment towards crypto assets. It is essential for investors to stay informed about the latest regulations and how they may impact their investments. By understanding the regulatory landscape, investors can make more informed decisions and navigate the market with greater confidence.