An In-depth Look at Cryptocurrency Forks

- Understanding the Basics of Cryptocurrency Forks

- Types of Cryptocurrency Forks Explained

- The Impact of Forks on the Cryptocurrency Market

- Famous Examples of Successful Forks in the Crypto World

- Challenges and Risks Associated with Forking

- How to Navigate the World of Cryptocurrency Forks Safely

Understanding the Basics of Cryptocurrency Forks

Cryptocurrency forks are a common occurrence in the digital currency world. A fork happens when a blockchain splits into two separate paths, creating two different versions of the original cryptocurrency. There are two main types of forks: hard forks and soft forks.

A hard fork is a permanent divergence from the original blockchain, resulting in two separate blockchains. This type of fork requires all nodes or users to upgrade to the latest version of the protocol software. On the other hand, a soft fork is a temporary split in the blockchain that is resolved when the majority of nodes upgrade to the new software.

Hard forks are often used to implement significant changes to a cryptocurrency’s protocol, such as altering the block size or adding new features. Soft forks, on the other hand, are typically used to implement minor upgrades or bug fixes. Both types of forks can lead to the creation of a new cryptocurrency, with holders of the original currency receiving an equal amount of the new coin.

It is essential for cryptocurrency investors to understand the basics of forks, as they can have a significant impact on the value and usability of a digital currency. By staying informed about upcoming forks and how they may affect their investments, investors can make more informed decisions about buying, selling, or holding their cryptocurrency assets.

Types of Cryptocurrency Forks Explained

Cryptocurrency forks can be categorized into different types based on their nature and impact on the blockchain network. Understanding these types is crucial for investors and enthusiasts to navigate the complex world of digital currencies. Here are the main types of cryptocurrency forks explained:

- Hard Forks: A hard fork occurs when a blockchain splits into two separate chains due to a fundamental change in the protocol. This type of fork is not backward-compatible, meaning that nodes running the old software will not be able to validate blocks on the new chain. Examples of hard forks include Bitcoin Cash and Ethereum Classic.

- Soft Forks: In contrast to hard forks, soft forks are backward-compatible upgrades to the blockchain protocol. This means that nodes running the old software can still validate blocks on the new chain. Soft forks are typically implemented to introduce new features or improve the network’s security. Segregated Witness (SegWit) is an example of a soft fork in Bitcoin.

- Contentious Forks: Contentious forks occur when there is a lack of consensus among the community regarding the proposed changes to the blockchain. This can lead to a split in the network, with some users supporting the forked chain and others sticking to the original chain. Contentious forks can result in a community divide and create uncertainty in the market.

- Non-Contentious Forks: Non-contentious forks, on the other hand, are upgrades to the blockchain that are widely accepted by the community. These forks are typically implemented to improve the network’s efficiency, scalability, or security. Non-contentious forks are less likely to cause a split in the community and are generally seen as positive developments for the cryptocurrency ecosystem.

Overall, cryptocurrency forks play a significant role in shaping the evolution of blockchain networks. By understanding the different types of forks and their implications, investors can make informed decisions about how to navigate the ever-changing landscape of digital currencies.

The Impact of Forks on the Cryptocurrency Market

Cryptocurrency forks have a significant impact on the market, influencing the value and perception of digital assets. A fork occurs when a blockchain splits into two separate paths, creating a new cryptocurrency. This can happen for various reasons, such as disagreements among developers or the need to update the network’s protocol.

Forks can be categorized into two main types: hard forks and soft forks. A hard fork is a permanent split from the original blockchain, resulting in two distinct cryptocurrencies. On the other hand, a soft fork is a temporary divergence that is compatible with the original blockchain. Both types of forks can lead to changes in the cryptocurrency market.

When a fork occurs, it can cause uncertainty and volatility in the market. Investors may be unsure about which version of the cryptocurrency to support, leading to price fluctuations. Additionally, forks can create confusion among users and developers, impacting the overall adoption and usage of the digital asset.

Despite the challenges that forks may bring, they can also present opportunities for investors. Some forks result in the creation of new and potentially valuable cryptocurrencies. By participating in a fork, investors may receive free coins or tokens, which can increase their overall holdings and diversify their portfolio.

Overall, forks play a crucial role in shaping the cryptocurrency market. They can lead to both challenges and opportunities for investors, developers, and users alike. Understanding the impact of forks is essential for navigating the ever-changing landscape of digital assets.

Famous Examples of Successful Forks in the Crypto World

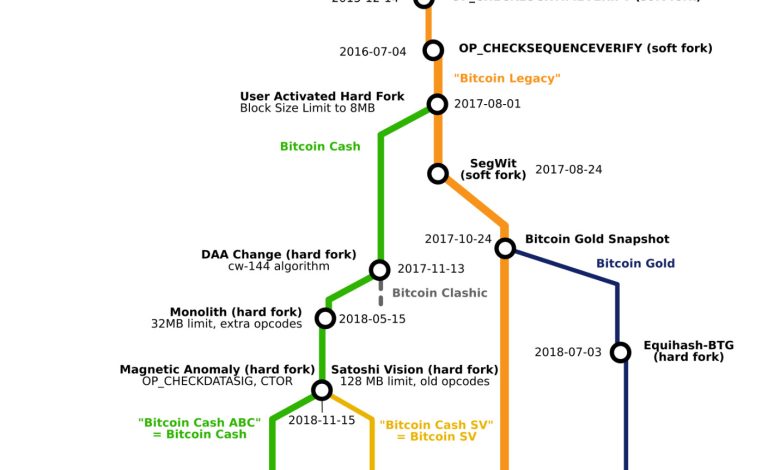

There have been several notable instances of successful forks in the cryptocurrency world that have made a significant impact on the market. One such example is the fork that led to the creation of Bitcoin Cash, a popular alternative to Bitcoin. This fork occurred in 2017 and was driven by disagreements within the Bitcoin community over how to scale the network to accommodate more transactions. Bitcoin Cash has since become one of the top cryptocurrencies by market capitalization, demonstrating the success of this particular fork.

Another famous example is the Ethereum fork that resulted in the creation of Ethereum Classic. This fork occurred in 2016 following a hack that exploited a vulnerability in the Ethereum code. The community was divided on how to address the issue, leading to a split in the network. While Ethereum Classic has not achieved the same level of success as its counterpart, it still remains a viable cryptocurrency with a dedicated following.

One more noteworthy example is the fork that led to the creation of Litecoin, often referred to as the silver to Bitcoin’s gold. Litecoin was created in 2011 by Charlie Lee, who made some modifications to the Bitcoin code to create a faster and more lightweight cryptocurrency. Litecoin has since gained popularity for its faster transaction speeds and lower fees, making it a successful fork in the crypto world.

Challenges and Risks Associated with Forking

When considering the **challenges** and **risks** associated with **forking** in the world of **cryptocurrency**, it is important to understand the potential implications of such actions. One of the main challenges is the **divergence** of the **community**, as **forks** can lead to **disagreements** among **developers** and **users**. This can result in a **split** in the **network**, causing **confusion** and **uncertainty**.

Another **risk** of **forking** is the **potential** for **security** **vulnerabilities** to arise. **Forks** can create **weaknesses** in the **code** that **hackers** may **exploit**, putting **investors** and **users** at **risk** of **losing** their **funds**. It is **crucial** for **developers** to **address** these **issues** promptly to **protect** the **integrity** of the **cryptocurrency**.

Furthermore, **forks** can also **impact** the **value** of a **cryptocurrency**. **Investors** may **react** **negatively** to a **fork**, causing the **price** to **fluctuate** **dramatically**. This **volatility** can **create** **instability** in the **market**, making it **difficult** for **traders** to **predict** **trends**.

How to Navigate the World of Cryptocurrency Forks Safely

When it comes to navigating the world of cryptocurrency forks, it is essential to proceed with caution to ensure the safety of your investments. Here are some tips to help you navigate this complex landscape:

- Research: Before engaging in any cryptocurrency fork, it is crucial to conduct thorough research to understand the implications and potential risks involved.

- Stay Informed: Keep yourself updated on the latest news and developments in the cryptocurrency space to make informed decisions about participating in forks.

- Secure Your Assets: Prioritize the security of your assets by using reputable wallets and exchanges to protect your investments from potential risks associated with forks.

- Diversify: Consider diversifying your cryptocurrency holdings to minimize the impact of any potential losses resulting from forks.

- Consult Experts: Seek advice from experienced cryptocurrency investors or financial advisors to gain insights into the best practices for navigating forks safely.

By following these guidelines, you can navigate the world of cryptocurrency forks with confidence and safeguard your investments against potential risks. Remember that staying informed and prioritizing security are key to successfully navigating this evolving landscape.