Understanding Crypto Wallets: Types and Safety

- What is a Crypto Wallet and How Does it Work?

- Types of Crypto Wallets: Hot vs Cold Wallets

- The Importance of Private Keys in Crypto Wallet Security

- Best Practices for Securing Your Crypto Wallet

- Hardware Wallets: The Safest Option for Storing Cryptocurrency

- Common Mistakes to Avoid When Using Crypto Wallets

What is a Crypto Wallet and How Does it Work?

A **crypto wallet** is a digital tool that allows users to securely store, send, and receive cryptocurrencies. It works by generating pairs of public and private keys, which are used to sign transactions and provide access to the funds stored in the wallet. When a user wants to send cryptocurrency to another wallet, they create a transaction using their private key, which is then verified by the recipient using the sender’s public key. This process ensures the security and integrity of the transaction.

There are several types of crypto wallets available, each with its own unique features and levels of security. **Hardware wallets** are physical devices that store the user’s private keys offline, making them less vulnerable to hacking. **Software wallets**, on the other hand, are applications or programs that can be installed on a computer or mobile device. **Online wallets** are cloud-based services that store the user’s private keys on a remote server, while **paper wallets** are physical documents that contain the user’s public and private keys.

Regardless of the type of wallet used, it is essential to follow best practices to ensure the security of your funds. This includes keeping your private keys secure and not sharing them with anyone, using two-factor authentication whenever possible, and regularly backing up your wallet to prevent data loss. By taking these precautions, you can protect your cryptocurrency investments and use your wallet with confidence.

Types of Crypto Wallets: Hot vs Cold Wallets

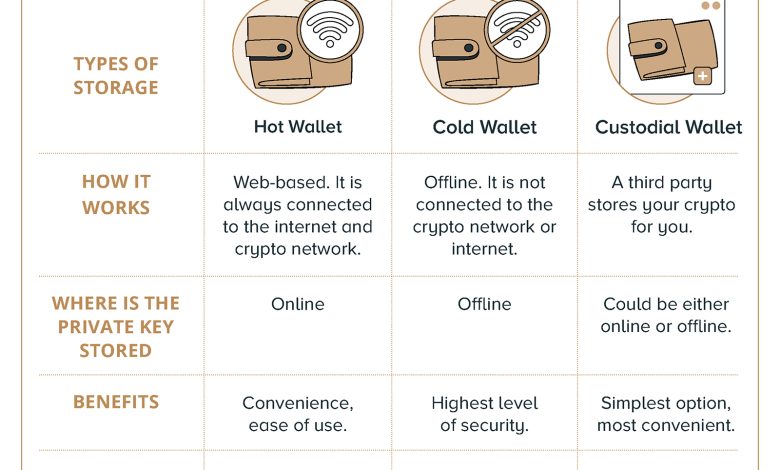

When it comes to crypto wallets, there are two main types to consider: hot wallets and cold wallets. Each type has its own set of advantages and disadvantages, so it’s important to understand the differences between them before deciding which one is right for you.

Hot wallets are connected to the internet and are more convenient for frequent trading and transactions. They are often provided by exchanges and can be accessed from any device with an internet connection. However, because they are online, hot wallets are more susceptible to hacking and security breaches.

Cold wallets, on the other hand, are offline and therefore less vulnerable to cyber attacks. They are typically hardware devices that store your cryptocurrency offline, making them a more secure option for long-term storage. While cold wallets may not be as convenient for day-to-day use, they are ideal for holding large amounts of cryptocurrency that you don’t plan on trading frequently.

The Importance of Private Keys in Crypto Wallet Security

Private keys are a crucial component of crypto wallet security. These keys are essentially long strings of alphanumeric characters that serve as a password to access and manage your cryptocurrency holdings. Without the private key, it is virtually impossible to access your funds, making it imperative to keep this key secure at all times.

When you create a crypto wallet, you are provided with a private key that is unique to that wallet. It is essential to store this key in a safe place, preferably offline, to prevent unauthorized access. If someone gains access to your private key, they can easily steal your cryptocurrency without your knowledge.

One of the most common ways to secure your private key is by using hardware wallets. These physical devices store your key offline, making it nearly impossible for hackers to access it remotely. Additionally, you can encrypt your private key with a passphrase for an extra layer of security.

It is crucial to never share your private key with anyone or store it online where it could be vulnerable to cyber attacks. By taking the necessary precautions to protect your private key, you can ensure the safety of your cryptocurrency investments and prevent potential loss or theft.

Best Practices for Securing Your Crypto Wallet

When it comes to securing your crypto wallet, there are several best practices you should follow to ensure the safety of your digital assets. Here are some key tips to keep in mind:

- Use a hardware wallet: Consider using a hardware wallet, which is a physical device that stores your private keys offline. This provides an extra layer of security compared to online wallets.

- Enable two-factor authentication: Adding an extra layer of security by enabling two-factor authentication can help prevent unauthorized access to your wallet.

- Backup your wallet: Make sure to regularly backup your wallet and store the backup in a secure location. This will help you recover your funds in case your wallet is lost or damaged.

- Keep your software up to date: Ensure that you are using the latest version of your wallet software to protect against any potential security vulnerabilities.

- Avoid public Wi-Fi: Be cautious when accessing your wallet on public Wi-Fi networks, as they may not be secure. It’s best to use a private network to prevent unauthorized access.

By following these best practices, you can help secure your crypto wallet and protect your digital assets from potential threats. Remember to stay vigilant and take proactive measures to safeguard your investments.

Hardware Wallets: The Safest Option for Storing Cryptocurrency

When it comes to storing cryptocurrency, security is paramount. Hardware wallets are widely considered the safest option for safeguarding your digital assets. These physical devices store your private keys offline, making them less vulnerable to hacking and cyber attacks compared to online wallets.

Hardware wallets come in various shapes and sizes, but they all serve the same purpose – to keep your cryptocurrency safe from unauthorized access. By storing your private keys offline, hardware wallets provide an extra layer of protection that online wallets cannot match. This added security feature makes them an ideal choice for long-term storage of your digital assets.

One of the key advantages of hardware wallets is their immunity to malware and viruses. Since they are not connected to the internet except when making transactions, the risk of your private keys being compromised is significantly reduced. This peace of mind is invaluable when dealing with large sums of cryptocurrency.

Another benefit of hardware wallets is their ease of use. Most hardware wallets come with simple interfaces that make it easy for even beginners to store and manage their cryptocurrency securely. With features like backup and recovery options, hardware wallets ensure that you never lose access to your digital assets.

Overall, hardware wallets offer the highest level of security for storing cryptocurrency. Their offline storage of private keys, immunity to malware, and user-friendly interfaces make them the preferred choice for many crypto investors. If you value the safety of your digital assets, investing in a hardware wallet is a wise decision.

Common Mistakes to Avoid When Using Crypto Wallets

When using crypto wallets, there are several common mistakes that users should avoid to ensure the safety and security of their digital assets. By being aware of these pitfalls, individuals can better protect their investments and prevent potential losses. Here are some key mistakes to steer clear of:

- Sharing Private Keys: One of the most critical errors to avoid is sharing your private keys with anyone. Your private key is essentially the password to your wallet, and sharing it compromises the security of your funds.

- Ignoring Software Updates: Another mistake is neglecting to update your wallet software regularly. Developers often release updates to patch security vulnerabilities, so staying up to date is crucial.

- Falling for Phishing Scams: Be cautious of phishing scams that attempt to trick you into revealing your wallet information. Always double-check URLs and never enter your private keys or seed phrases on unverified websites.

- Using Public Wi-Fi: Avoid accessing your crypto wallet on public Wi-Fi networks, as they are more susceptible to hacking. Stick to secure, private networks to minimize the risk of unauthorized access.

- Not Backing Up Your Wallet: Failure to back up your wallet is a common mistake that can result in permanent loss of funds if your device is lost or damaged. Always create a secure backup of your wallet and store it in a safe place.

By steering clear of these common mistakes, crypto wallet users can enhance the security of their digital assets and minimize the risk of theft or loss. Stay vigilant, stay informed, and prioritize the safety of your investments in the world of cryptocurrency.